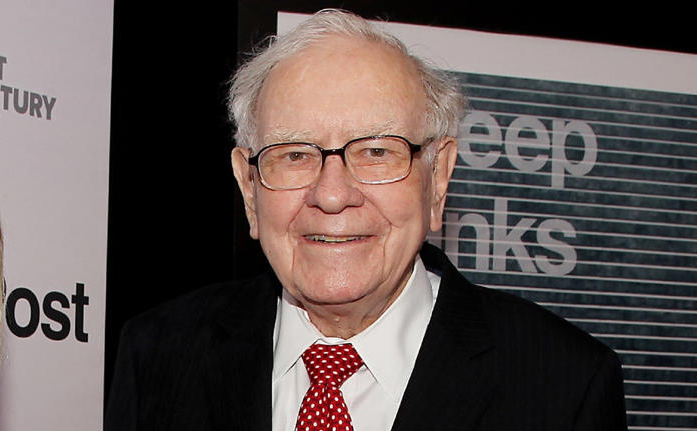

Warren Buffett is one of the most respected figures in the investment world today. He is not just a wealthy individual; his way of life and investment philosophy inspire many. Particularly, the story of how Buffett became a millionaire at the age of 32 offers life-changing lessons to many. In this article, we will explore how Buffett could become a millionaire at a young age and what lessons we can learn from his journey.

1. Buffett’s Frugal Lifestyle and the Secret of His First Million Dollars

One of the most striking features of Warren Buffett’s life is his frugality. Buffett starts his day with a cheap breakfast at McDonald’s and still lives in the Omaha home he purchased for $31,500 in 1958. He avoids extravagant spending and has maintained his core values through a modest lifestyle. Buffett’s achievement of becoming a millionaire at 32 was a result of his frugality and investment philosophy.

Buffett started buying stocks at the age of 11 and gradually built his wealth. When he became a millionaire at 32, it was the outcome of his consistent investing over a long period. He believed in the “magic of compounding,” steadily increasing his assets. His success wasn’t just luck; it was the result of critical moments underpinned by thorough analysis and patience.

2. The Importance of Continuous Learning and Reading

Warren Buffett has never stopped learning throughout his life. He reads about 500 pages of books and various materials daily, accumulating knowledge, which has been a crucial element in his investment decisions. Buffett’s deep understanding of companies, markets, and stocks through reading allowed him to make informed investment choices.

Buffett’s reading habits are one of the reasons he could become a billionaire. Reading provided him with new perspectives, minimized risks, and laid the foundation for successful investments. His reading habits were not just about gaining knowledge but also gave him the power to make significant decisions throughout his life.

3. Value-Oriented Investing and Its Results

One of Buffett’s successful investment strategies is “value-oriented investing.” This involves buying undervalued stocks and holding onto them for the long term to realize their value. Buffett preferred companies that were solidly positioned but undervalued compared to their intrinsic value. He chose companies that performed well over the long term, resulting in stable profits.

Buffett doesn’t sell stocks in the short term and emphasizes realizing stock value over time. He stated that “slow and steady wins the race,” focusing on long-term value growth rather than hasty trading.

Conclusion: Life Lessons from Warren Buffett

Warren Buffett’s life is more than just about accumulating wealth; it reflects a philosophy and values that resonate deeply. His frugal lifestyle, continuous learning, and value-oriented investment philosophy continue to inspire many people today. We can learn from his story that patience and thorough preparation are the keys to success.

By applying the lessons learned from Buffett’s life, we too can live a more stable and meaningful life. Start practicing Warren Buffett’s philosophy today. Success is not far away.

References

- GOBankingRates, “At What Age Did Warren Buffett Become a Millionaire?”

- CNBC Make It, “Warren Buffett’s Path to Wealth: Lessons in Patience and Persistence”

- Financial Post, “Warren Buffett’s Reading Habits and Investment Philosophy”