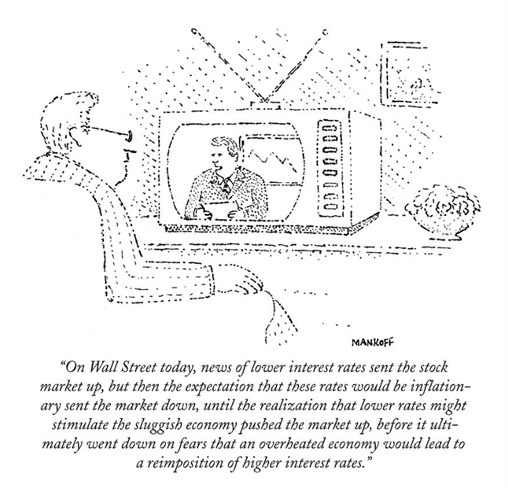

Investing is a fascinating journey, but along the way, we frequently encounter a fictional character known as “Mr. Market.” Introduced by Benjamin Graham, this character symbolizes the market’s volatility and emotional swings that investors face daily. Mr. Market offers us his opinions on stock prices every day; sometimes, these seem reasonable, but often they are absurd, driven by emotion. In short, our reactions to market volatility directly impact our investment performance.

Mr. Market’s Whims and Investor Opportunities

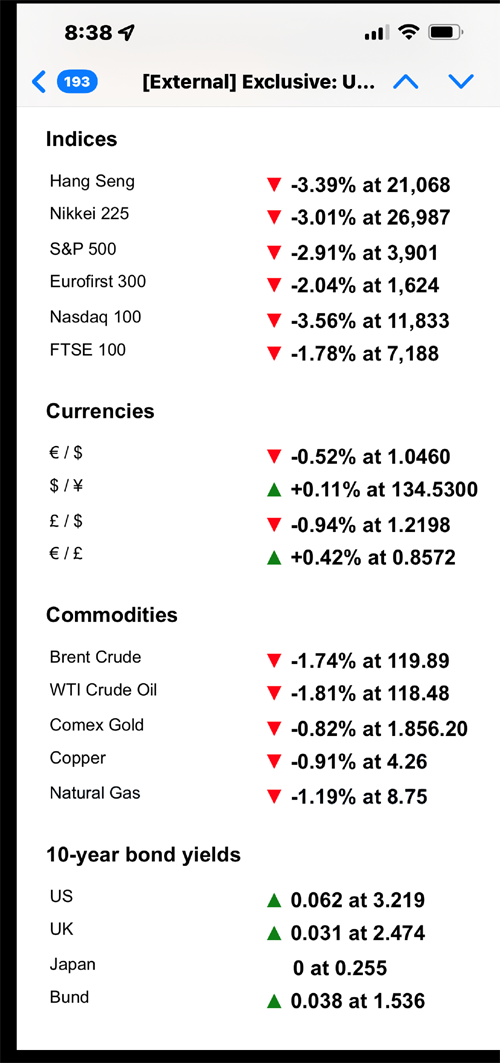

In early August 2024, we once again witnessed Mr. Market’s erratic nature. The market experienced sharp declines and rebounds in a short period, evoking strong emotions among investors. The announcement of an interest rate hike by the Bank of Japan and mixed economic indicators from the U.S. significantly affected investor sentiment.

In the investment world, there’s a saying called the ‘pendulum of emotion.’ This pendulum swings between positive expectations and negative concerns, driving market price movements. For example, from 2023 to 2024, the S&P 500 index showed a sharp upward trend, reflecting investors’ positive assessments of economic recovery and anticipated interest rate cuts. However, when the market reversed, those expectations quickly collapsed.

These emotional swings present opportunities for investors. When the market is overly optimistic or pessimistic, rational judgment can reveal investment opportunities.

The Role of Emotions and Irrationality in Investing

Investors often interpret and act in the market based on their emotions. Psychological factors like cognitive dissonance further reinforce this behavior. Investors tend to ignore or distort information that doesn’t align with their expectations. For instance, the optimistic atmosphere in the U.S. market in 2022 persisted despite negative factors like interest rate hikes. However, as reality set in, the market rapidly declined. It’s crucial for investors to recognize the impact of their emotions on the market and to control these emotional reactions.

Conclusion: The Need for Investor Cool-headedness

The market fluctuates daily, but these fluctuations are not always based on fundamentals. Often, investor emotions and psychology drive the market. Therefore, focusing on fundamentals rather than being swayed by market volatility is key to long-term success.

Take advantage of Mr. Market’s whims, and become a wise investor who leverages his emotional misjudgments. Now is the time to invest based on analysis, not emotion.

Reference: Howard Marks, “The Illusion of Knowledge”