The stock market often behaves unpredictably, much like a rollercoaster. Many investors get caught up in this volatility, leading to anxiety and sometimes even panic-driven decisions. However, it is crucial to maintain composure in the midst of this chaos. In this article, we will discuss how to remain steady and make sound decisions despite the market’s fluctuations.

Understanding Volatility and Its Risks

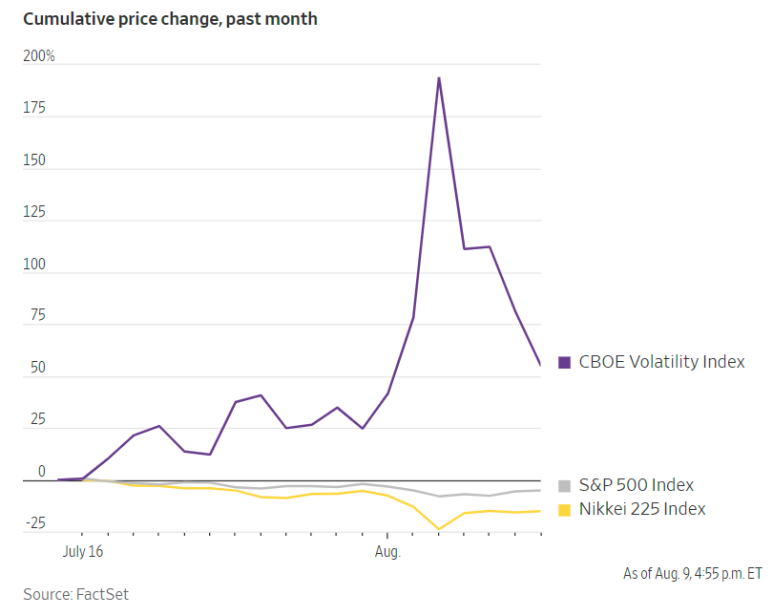

The stock market is inherently volatile. It experiences sharp declines and sudden surges, keeping investors on edge. The causes of this volatility can vary, including economic conditions, political events, technological changes, and more.

Volatility is a natural phenomenon, but misunderstanding it or reacting inappropriately can lead to significant losses. Overreacting to market movements or selling in fear can result in long-term financial damage.

The Pitfalls of Sensationalized Media and Marketing

You’ve likely seen headlines like “Market Crash!” in the news or on social media. These sensational titles grab attention but are often exaggerated. While the market’s changes are presented as major events, the reality behind them might not be as dramatic.

For instance, a headline about the Dow Jones dropping over 1,000 points might seem alarming at first glance. However, this figure is often highlighted without considering the overall scale of the Dow Jones. It is crucial to assess the situation with a cool head.

How to Stay Calm

So, how can you maintain your composure during market volatility? Here are a few suggestions:

- Maintain a Long-Term Perspective: The stock market should be approached with a long-term view rather than reacting to short-term fluctuations. Temporary declines are likely to recover over time.

- Practice Critical Analysis: Develop the habit of critically analyzing all news and information. It is important to make decisions based on facts rather than emotions.

- Build a Diversified Portfolio: By diversifying your investments, you can reduce the risk associated with the volatility of specific stocks or sectors.

- Leverage Expert Advice: While it is beneficial to consider expert opinions, it’s essential to apply them in a way that suits your situation without blindly following them.

Conclusion: Volatility as an Opportunity

Stock market volatility offers not just risks but also opportunities. The key is how you capitalize on these opportunities. By staying analytical and focusing on the long term, you can turn market fluctuations into successful investment strategies. With these guidelines, you too can navigate the stock market’s rollercoaster with confidence.

Reference: Jason Zweig, “How to Stay Sane When Markets Get Wild”