In the investment world, “smart money” refers to funds led by knowledgeable experts. However, even smart money can sometimes make mistakes. This article will explore the key lessons investors shouldn’t miss by analyzing the movement of smart money.

Smart Money and Their Choices

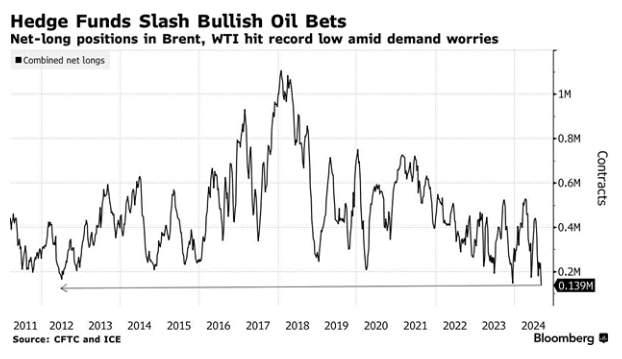

Investors often try to follow the decisions of great investors like Warren Buffett and Carlos Slim. But, smart money isn’t always right. Recently, a chart stopped many investors in their tracks as most experts were pessimistic about the outlook for oil and natural gas. Here’s why:

- China’s economic recovery is slow.

- There is a possibility of a recession in the U.S.

- There is a chance of a ceasefire in the Middle East.

- OPEC+ might increase production.

Such “well-known facts” can sometimes spark movements contrary to market expectations. When smart money flows in one direction, it’s wise to be cautious.

Opportunities in the Past and Present

We must remember that smart money has been wrong before. In 2011, smart money was extremely pessimistic about China’s economy. Many investors avoided oil and gas stocks due to this sentiment. But the results were unexpected. China’s economy didn’t shrink as much, and those who invested during that period made substantial gains.

A similar situation occurred after the 2007-2009 Great Recession. Many experts predicted a 2% drop in gasoline consumption, but the impact wasn’t as severe. Oil and natural gas remained critical resources, and demand persisted.

Energy Investment Opportunities Today

Even today, smart money is pessimistic. But this could actually be an opportunity. The slow recovery of China’s economy and the possibility of peace in the Middle East could lead to positive outcomes in the long term. Now is the time for investors with a long-term perspective to seize the opportunity as smart money exits.

Increased electricity demand within the U.S. and the rise of natural gas power generation make oil and gas stocks attractive investment options. In particular, Canada’s long-lifespan oil assets could offer a stable long-term income opportunity for investors.

Future Investment Strategy

We have learned what opportunities lie when smart money is wrong. The key is accurate market analysis and a long-term investment outlook. This is why giant investors like Warren Buffett keep a long-term view on the market.

It’s important for investors to carefully monitor smart money’s movements. However, their decisions aren’t always right. Sometimes, going against the crowd may be the better choice. Now may be the time to consider investing in oil and natural gas stocks with a long-term outlook. Consider long-term investments with a positive perspective.

References: Smead Capital Management, “When Smart Money is Wrong”