The reason why debates about the stock market never seem to end is simple: people are looking at different time horizons. One person might have a positive outlook for a particular stock over the next few years, while another might warn of a significant drop within weeks. These conflicting opinions can easily confuse investors.

1. Differences Between Investment and Speculation

Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, once said, “Speculators buy the trend, but investors buy for the long term. They are different breeds of cat.” This quote clearly highlights the fundamental difference between investment and speculation.

Investors view the market with a long-term perspective. They understand that short-term fluctuations are normal and focus on assets likely to appreciate over time. Speculators, on the other hand, aim for quick profits. They follow market trends and move quickly to buy and sell.

However, here’s where the problem arises. Many people think of themselves as investors but behave like speculators. They claim to have long-term goals but often consider selling at the slightest dip in stock prices.

2. Walking Both Paths: Investment and Speculation

Many people in the stock market attempt to walk both paths simultaneously. They base their strategy on long-term investments while also engaging in speculative trades to achieve short-term gains. This approach can sometimes lead to great success, but it can also result in significant losses.

The most important thing is to clearly understand what you are doing. If you are investing for the long term, you should remain steadfast despite short-term volatility. On the other hand, speculative trading requires quick decision-making and agility.

3. Interpreting Information: Understand the Timeframe

The first question to ask when hearing opinions about the stock market is, “What is the timeframe?” This is because the same expert might predict a market drop in the coming weeks while also forecasting a rise in the years ahead. These statements are not contradictory—they simply reflect different timeframes.

Investors need to understand the source of the information and the motivations behind it. For example, when a famous hedge fund manager on TV warns of a market crash, they are often focused on short-term volatility. However, these short-term predictions should not necessarily influence long-term investment decisions.

4. Long-Term vs. Short-Term: Two Truths

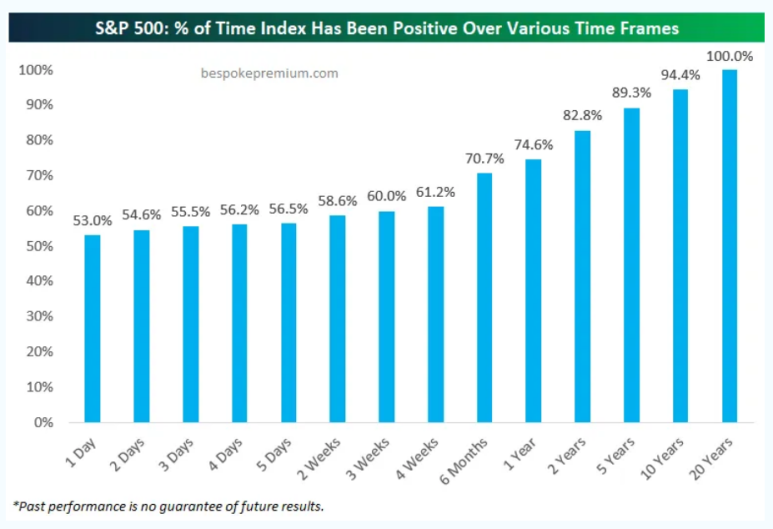

One truth about the stock market is that “the long game never loses.” This means that, over time, the stock market is likely to rise. The second truth is that “in the short term, you can take a big hit.” Long-term investors should be prepared to experience many downturns during their journey.

These two truths are not contradictory. Instead, they emphasize the need for investors to maintain a long-term view while also preparing for short-term volatility. The stock market may be unstable in the short run, but it has a high likelihood of steady growth over the long term.

Conclusion: Clearly Define Your Path

The most important thing for anyone entering the stock market is to clearly recognize whether they are an investor or a speculator. If you have long-term goals, don’t let short-term market fluctuations shake your resolve—stick to your path. Conversely, if you seek short-term profits, be prepared to act swiftly and decisively.

Ultimately, successful investing comes down to clearly understanding your goals and strategy and acting accordingly. The stock market offers countless opportunities, but to seize them, you must know exactly what type of investor you are.

Reference: TKer by Sam Ro, “The first question to ask when a markets expert speaks”