Consistency, The Power That Leads to True Success

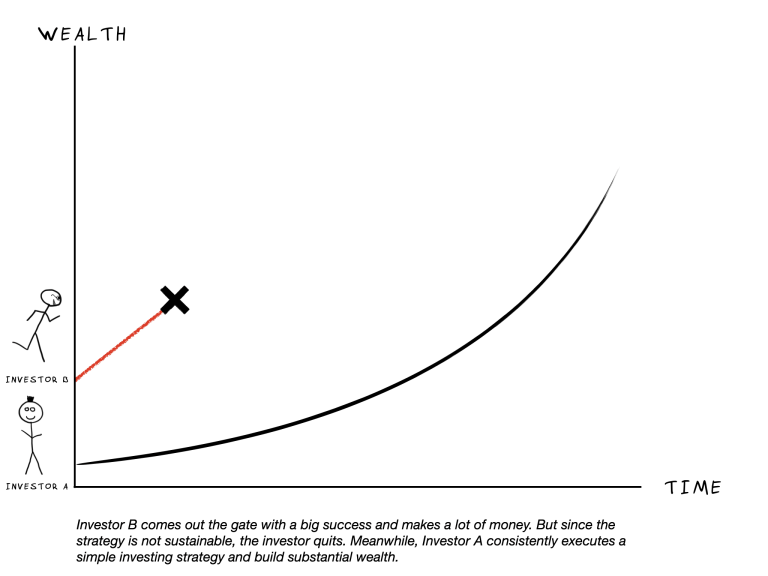

Successful investing is not about finding the best strategy but about sticking to an effective one. In today’s world, this is one of the hardest things to do.

In fact, if you don’t have a clear way to manage your emotions, maintaining consistency as an investor can be impossible. Spend just 10 seconds on YouTube, Instagram, or X, and you’ll see 20 people with conflicting opinions.

Don’t invest in stocks! Buy real estate instead!

The housing market is going to crash, so buy gold!

Everything is going to crash, so buy Bitcoin!

Yet, those preaching the sure ways to get rich are all wealthy with millions of dollars in assets. They speak as if they have the “perfect” solution for investing.

Howard Marks warned about such people in his book “Mastering the Market Cycle”:

Over my 48-year career, I’ve seen dozens of supposedly foolproof investment secrets promoted. None of them have proven true. There is no strategy or tactic that can guarantee high returns with no risk, especially not for those lacking sophisticated investment skills.

If there were a panacea, we would all know about it. It wouldn’t be a secret.

In my 17 years of investing, I’ve read nearly all the essential investment books. I’ve spoken with extremely wealthy individuals.

The secret to building wealth is simple: Set your investment strategy and stick to it unwaveringly. Stay on the path.

My father’s best friend is an accountant who works with some of the wealthiest people in the Netherlands. During a recent lunch where we discussed wealth building, he shared:

Most of my wealthy clients have become richer through inheritance. And, of course, there’s a small group that started with nothing and became wealthier over time.

This is the harsh reality that no one talks about. You won’t hear about it on social media.

If you want to become rich, you don’t have to hit a home run. It’s better to forget about those who make hundreds of thousands or millions of dollars a month because the odds of that happening are extremely low.

It’s much better to aim to become a little bit richer every year. This aligns with the Stoic way of life. One of the strictest Stoic philosophers, Epictetus, said:

No great thing is created suddenly, any more than a bunch of grapes or a fig. If you tell me you desire a fig, I answer you must give it time. First, let it blossom, then bear fruit, then ripen.

Similarly, if you say you want to become wealthy, I will tell you it takes time.

You must keep working, saving money, and investing that money. And you must repeat this process.

You have to give it your best.

Reference: Darius Foroux, “Stoic & Wealthy #3: On consistency”