In the investment world, portfolio rebalancing is an essential strategy.@note It plays a crucial role not just in pursuing profits but also in managing risks.@note Through this, investors can expect more stable performance. In this article, we will explore the purpose and benefits of rebalancing, as well as its importance through real-world examples.

Tactical Rebalancing

Elizabeth O’Brien of Barron’s discussed portfolio rebalancing, highlighting the importance of market timing. Considering the recent strength of the stock market, should retirees consider reallocating some of their growth stocks into bonds, value stocks, or real estate?

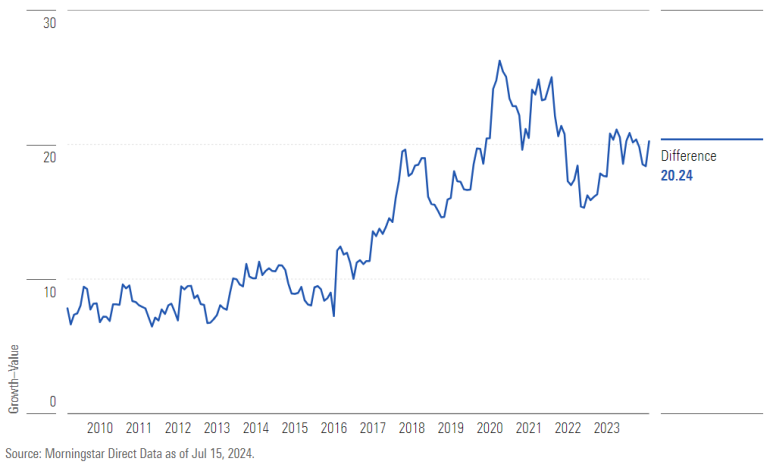

It is possible. While identifying the right trades isn’t easy, now might be an opportune time to reassess growth stock exposure. The following chart shows the difference in P/E ratios between the Morningstar U.S. Growth Index and the Morningstar U.S. Value Index over the past 15 years.

Growth stocks have occasionally commanded a higher premium, but it is not a frequent occurrence.

Advantages of Strategic Rebalancing

Let’s explore the ongoing benefits of rebalancing.

- The first point is that if the long-term total returns of two assets are identical, rebalancing will always result in higher returns.@note This is a mathematically certain fact. Rebalancing means trimming the winners and redistributing them to the losers.

- The greater the disparity in returns between assets, the larger the rebalancing bonus. When one asset rises by 5% and another by 3%, the rebalancing transaction might be minimal, but reallocating from an asset that has doubled to one that has halved results in a substantial outcome.

Case Study: Hypothetical Scenarios

To illustrate the above lessons, we created five portfolios from January 2015 to June 2024 and evaluated their outcomes. The initial allocation of each portfolio was evenly divided between the following two investments:

- U.S. stocks and U.S. cash

- U.S. stocks and U.S. bonds

- U.S. growth stocks and U.S. value stocks

- U.S. stocks and international stocks

- U.S. stocks and gold

In reality, these assets recorded very different results over the long term. For example, U.S. stocks tripled the initial capital, while U.S. cash barely moved.

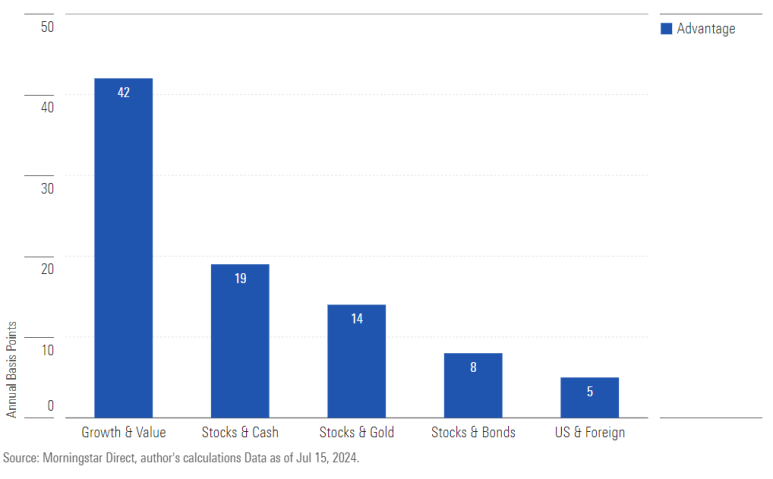

Benefits of Rebalancing: Assuming Equal Long-Term Returns

The following chart demonstrates the benefits of rebalancing, assuming equal long-term returns.

The Earth still revolves around the Sun, steam is hotter than ice, and light continues to travel at 186,000 miles per second. Just as rebalancing improves performance when all portfolio assets have equal long-term returns.

Rebalancing in Reality

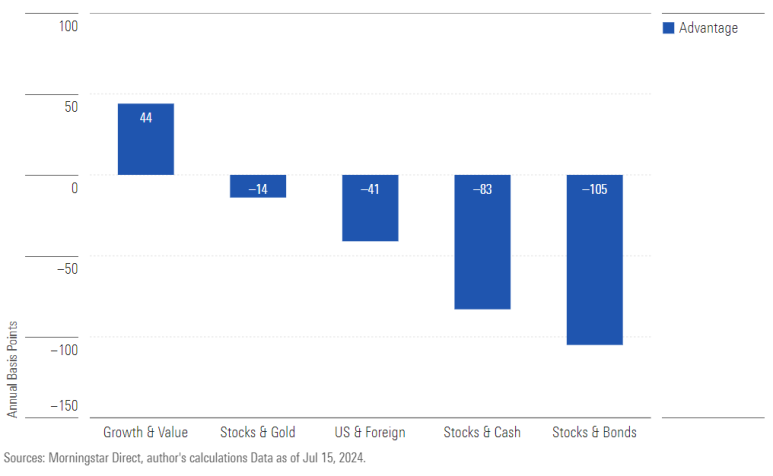

Hypothetical scenarios are helpful in explaining the logic of rebalancing. But in reality, assets do not regularly achieve the same long-term returns. What were the actual benefits of rebalancing when using the same portfolio assumptions over the same 9.5-year period?

The result was no significant advantage.

The Benefits of Rebalancing: Real Returns

The following chart shows the results of rebalancing in reality.

Swapping between growth and value stocks was still beneficial. However, in other cases, rebalancing reduced the portfolio’s returns.

Conclusion: The Real Impact of Rebalancing

The goal of this article is to clarify the assumptions underlying rebalancing. Assuming no transaction costs (tax considerations are another matter), rebalancing is suitable for investments that march to different beats but are likely to end up in similar positions.

A prime example is growth and value stocks. Rebalancing between U.S. and international stocks also makes sense. However, rebalancing between stocks and low-yielding assets is less clear.

Rebalancing can offer a free lunch, but not always. Investors, remember to periodically review your portfolio and manage risks through appropriate rebalancing.

References: MorningStar, “When Rebalancing Creates Higher Returns—and When It Doesn’t”