Venture capital for tech startups and scaling the business for acquisition may seem like the only way to get rich, but it’s merely one approach. While this strategy is common in Silicon Valley, there are plenty of alternative paths to wealth. Let’s explore various ways to become wealthy beyond the tech startup route.

Tech Startups Are Not the Only Answer

While tech startups are a powerful tool for creating wealth, they are not the only option. For example, Todd Graves, the founder of Raising Cane’s, started with a small restaurant serving chicken fingers and fries. He expanded his business by optimizing cash flow without massive investments.

The Importance of Smart Capital Utilization

Tech startups often rely on venture capital, but Graves raised funds through bank loans. [This approach allowed him to maintain capital control while growing his business.] Many startups must give up equity to outside investors, which can restrict management freedom. However, by minimizing external capital, Graves remained the majority shareholder, reaping significant dividends.

Leverage Loans and Dividends: Maximizing Profit Strategy

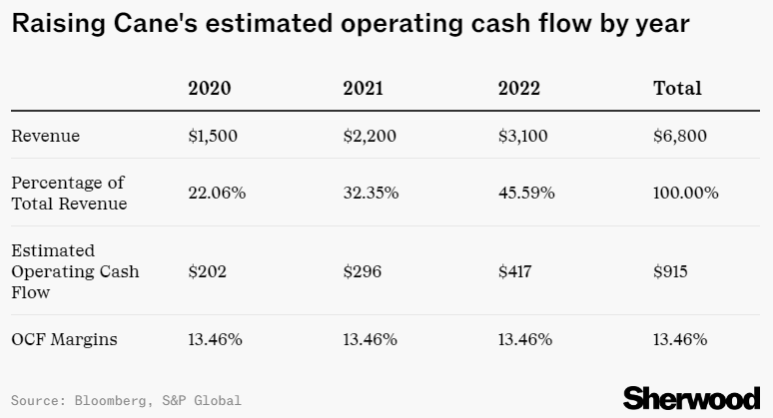

Another key to Graves’ success was optimizing capital structure through leverage loans. Recently, Raising Cane’s sold $500 million in leveraged loans to pay off existing debt and increase dividends. This was a smart strategy, leveraging stable revenue growth.

How to Maximize Dividend Income

Raising Cane’s pays a percentage of its revenue as dividends, with 90% going to Graves. His dividend income reaches millions of dollars. His story shows that business expansion is not the only path to wealth. Stable cash flow and a smart dividend policy contribute significantly to maximizing profits.

Creating a $10 Billion Value with Chicken Fingers

Todd Graves’ success proves that a founder can become wealthy without selling equity to outsiders. He expanded his business and maximized profits without selling to a large corporation or relying on venture capital. His assets are now worth $10 billion, demonstrating the effectiveness of his strategy.

Lessons for Entrepreneurs

As this case demonstrates, there are various ways for entrepreneurs to create wealth while maintaining control over capital. Remember, success is possible without venture capital. By maintaining a proper capital structure and smart financial management, anyone can become wealthy.

Conclusion: Multiple Paths to Wealth

There are many ways to become wealthy without relying on venture capital or giving up equity. Like Raising Cane’s, optimizing cash flow and maximizing dividend income can be efficient ways to build wealth. You, too, can create wealth through your business. Success is in your hands!

Source: Sherwood, “Raising Cane’s founder makes hundreds of millions in dividends”