Isn’t doubling your money the dream of every investor? I believe it is for you too. The time to achieve this goal depends on the investment return rate. An annual return rate of 8% is a powerful tool to rapidly increase wealth over time. Today, we will explore two scenarios to understand how to double your money.

Doubling Money with Compound Interest

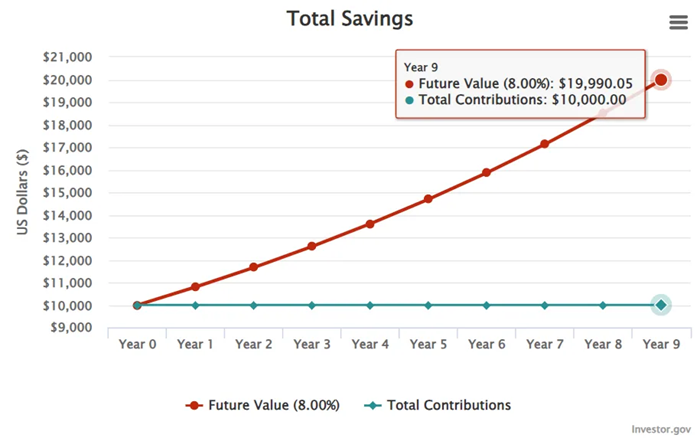

Compound interest is a very powerful concept that can rapidly increase your money. The formula for compound interest is A = P(1+r)^n. Here, A is the final amount, P is the principal investment, r is the annual return rate, and n is the period (years). A quick and easy way to estimate the time to double your money with compound interest is to use the Rule of 72. Simply divide 72 by the annual return rate. For instance, with an 8% return rate, it takes about 9 years to double your money (72/8 = 9).

Let’s assume you invest $10,000 at an annual return rate of 8%. How does the principal grow with compound interest? Here’s the calculation:

- Year 1: $10,800

- Year 2: $11,664

- Year 3: $12,597

- Year 4: $13,605

- Year 5: $14,693

- Year 6: $15,869

- Year 7: $17,138

- Year 8: $18,509

- Year 9: $19,990

As seen above, the initial $10,000 doubles to $19,990 after 9 years. You can truly feel the power of compound interest here, experiencing the exponential growth of money over time.

Doubling Money with Simple Interest

Simple interest earns a fixed return rate each year on the initial principal without reinvesting the earnings. The formula for simple interest is A = P(1+rt). Here, A is the final amount, P is the initial principal, r is the annual return rate, and t is the period (years).

With an 8% simple interest rate, if you invest $10,000, the principal increases by $800 each year. It takes 12.5 years to double the initial principal (10,000/annual 800 = 12.5 years).

In the compound interest scenario, it takes only 9 years to double the principal, while in the simple interest scenario, it takes 3.5 years longer to achieve the same goal.

The Power of Compound Interest

The difference between compound and simple interest becomes more pronounced over a long period. For instance, if you invest $10,000 at an 8% return rate for 30 years, it grows to $100,627 with compound interest and to $34,000 with simple interest. This stark contrast highlights the importance of reinvesting earnings. Reinvesting returns into the principal makes your money work harder over time, ultimately leading to a much greater accumulation of wealth.

Finding Investments with an 8% Return Rate

To double your money at an 8% return rate, it’s crucial to choose the right investments. Let’s explore two potential options: dividend stocks and alternative high-yield investments.

Dividend Stocks

Finding reliable high-yield dividend stocks is one way to achieve an annual return of 8%. Many dividend stocks have a history of annual dividend increases, which keeps the return rate growing. However, high-yield dividend stocks tend to have slower price appreciation as a significant portion of earnings is paid out to shareholders rather than reinvested into the company’s growth.

One option to consider is Altria Group, well-known in the tobacco industry for its robust dividend yield and consistent dividend payments. With a forward dividend yield of 8.57% and 54 consecutive years of dividend increases, Altria presents an attractive option for income-focused investors.

Alternative High-Yield Investments

For investors looking to diversify beyond traditional dividend stocks, the Ascent Income Fund by EquityMultiple offers an intriguing opportunity. This fund focuses on private credit investments targeting stable returns from senior commercial real estate debt positions. Historically, the Ascent Income Fund has delivered a dividend yield of 12.1%, significantly exceeding the 8% benchmark we’ve discussed.

Conclusion

The time it takes to double your money at an 8% return rate depends on whether the interest is compounded. Using compound interest, it takes about 9 years to double the principal, whereas with simple interest, it takes 12.5 years. Believing in the power of compound interest and choosing investments that offer high return rates and compounding potential can accelerate your wealth-building journey.

Now, it’s time to review your investment strategy. Find investments with an 8% return rate and start building your wealth. Wishing you success in your investment journey!

References: Benzinga, “How Long Does It Take To Double Your Money On An Investment With An 8% Yield?”