The commodity market is a complex yet fascinating topic. You’ve likely heard the saying, “When commodity prices rise, it’s a great investment opportunity.” But is that really true? Why do commodities like commodities experience such regular cycles of booms and busts?

Are Commodities Only Valuable When Prices Rise?

What comes to your mind when you think of the commodity market? In recent years, the sharp rise in commodity prices has excited many investors. For example, whenever the price of oil spikes, headlines often scream, “Oil Prices Surge to All-Time High!” However, these headlines often transform into “Oil Prices Plunge, Investors Suffer Major Losses” just a few months later.

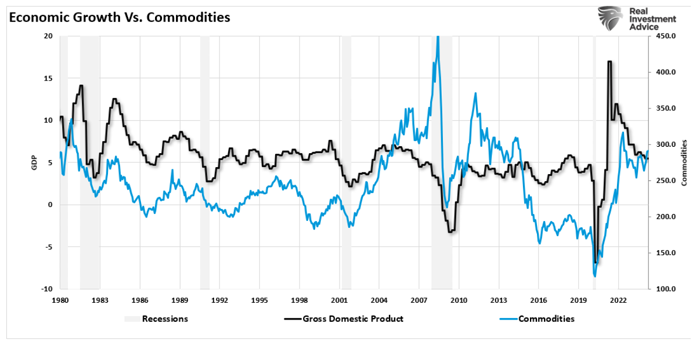

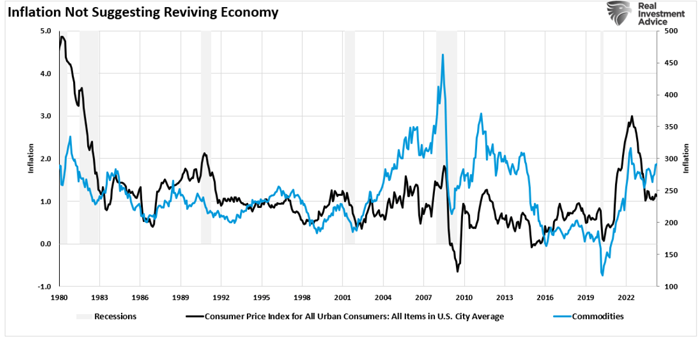

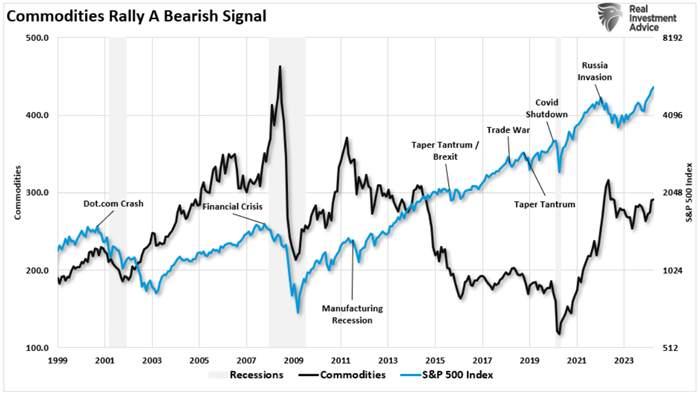

The cycle of sharp increases and decreases in commodity markets is not a new phenomenon. The “Peak Oil” of 2007 is just one example, and many other commodities have followed a similar path before. So, why do commodities go through cycles of boom and bust?

The Start of the Cycle: Imbalance Between Supply and Demand

The boom and bust of commodity markets usually begin with an imbalance between supply and demand. Initially, demand exceeds supply, driving prices up. For instance, imagine a year where a drought destroys the entire crop of oranges, reducing the supply of orange juice. Since the demand for orange juice remains high, prices rise. But this is just the beginning. As prices rise, investors start pouring more money into the market. Speculators on Wall Street begin buying up orange juice futures contracts, pushing prices even higher.

The Consequences of Speculative Trading

Speculative trading by investors drives commodity prices even higher. But at this point, problems begin to emerge. Orange farmers, seeing these high prices, start planting more oranges. Over time, supply begins to outpace demand. What happens next? Prices start to fall again. Speculators quickly sell off their futures contracts to avoid losses, accelerating the price decline. Eventually, the commodity market swiftly transitions from boom to bust.

Lessons to Learn from the Commodity Market

The commodity market can be enticing, but it also carries significant risks. As you may know, while price increases can be exhilarating, reversals can come just as quickly. Therefore, when investing in commodities, it’s crucial to consider taking profits before it’s too late. Be cautious not to hold investments for too long. Understanding that this cycle repeats itself is key to developing a sound strategy.

Conclusion: Know the Commodity Cycle Before Investing

The commodity market has much to teach us. Rather than jumping in just because prices are rising, it’s essential to understand the underlying factors and predict the cycle’s end. I hope this article helps deepen your understanding of the commodity market, enabling you to make wiser investment decisions. The commodity market is both an opportunity and a risk. Understanding its cycles is the path to successful investing.

Reference: Lance Roberts of Real Investment Advice, “Commodities And The Boom-Bust Cycle”