Index funds are perceived as a simple investment method by many investors. These funds are attractive because they allow you to follow the performance of the entire market without the need for complex stock selection or market predictions. However, simplicity does not necessarily mean ease. Why do so many investors fail even when choosing index funds?

1. The Appeal and Pitfalls of Index Funds

Index funds aim to match the average performance of the stock market. They generate returns according to market trends and are known as a favorable strategy for long-term investors due to their low fees. However, many investors, drawn to this simplicity, often make poor decisions swayed by market temptations.

For example, it is common for investors to buy index funds during a sharp market rise and then panic and sell when the market declines. This behavior can lead to long-term losses.

2. The Reality of Investor Returns

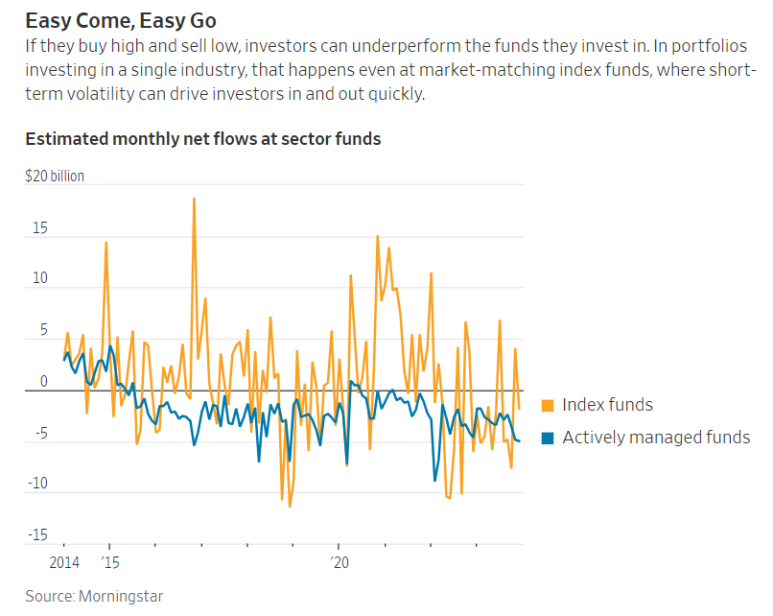

In fact, according to research by Morningstar, many investors achieve lower returns than the average returns of the funds they own. Over the past 10 years, investors have earned an average annual return of 6.3%, which is 1.1% lower than the returns of the funds they own. This gap occurs because investors often try to time the market, reacting to volatility.

3. The Risks of Sector Index Funds

Sector-focused index funds, especially those concentrated in areas like technology or energy, exhibit greater volatility. For instance, the XLK ETF, representing the technology sector, rose by 56% in one year, only to fall by 28% the next year. Such volatility can lead investors to continuously expect high returns and ultimately trade at the wrong times.

4. The Truth About Smart Beta Funds

Smart beta or factor funds group stocks or bonds with specific statistical characteristics for investment. These funds may seem like a simple investment method, similar to index funds, but in reality, they are not. For example, the SPLV ETF outperformed the S&P 500 in 2022, but recorded significant losses the following year. This is a common trap when investors rush to chase returns.

Conclusion: Advice for Successful Index Fund Investing

Understanding the value of simplicity is crucial for successful index fund investing. It’s important to diversify as much as possible across broad index funds and avoid impulsive trading based on market volatility. Only a small portion of your portfolio should be used for trading, and the strategy should focus on long-term stability rather than chasing quick profits.

Index funds are simple, but leveraging that simplicity effectively requires patience and wisdom. The most important aspect of investing is avoiding haste and maintaining a long-term perspective.

Source: Jason Zweig, “Messing Up the Closest Thing to a Sure Thing in the Stock Market”