Warren Buffett’s investment strategies continue to inspire investors worldwide. Among his many methods, the ‘$1 Test’ stands out as a simple yet effective tool for assessing whether a company is generating value for its investors. Today, we’ll explore this straightforward technique and take the first step toward successful investing.

1. What is Warren Buffett’s $1 Test?

Warren Buffett’s ‘$1 Test,’ emphasized in his communications with shareholders, is a straightforward method to measure how effectively a company uses its retained earnings to create value. While companies generate profits every year, their long-term success depends on how they utilize those profits.

Buffett’s method revolves around the fundamental question: “Does the retained $1 create at least $1 of market value?” Answering this question is the core of this test.

2. How the $1 Test Works

Though simple, the test’s impact is remarkable. By comparing a company’s retained earnings with its market value increase, investors can assess its value. The basic process of the test is as follows:

- 1. Determine how much profit the company retains each year.

- 2. Evaluate how much the company’s market value has increased over time.

- 3. Compare retained earnings with the market value increase and analyze the difference.

This process quickly reveals whether a company is effectively utilizing its retained earnings or squandering them.

3. ITC, Asian Paints, Voltas

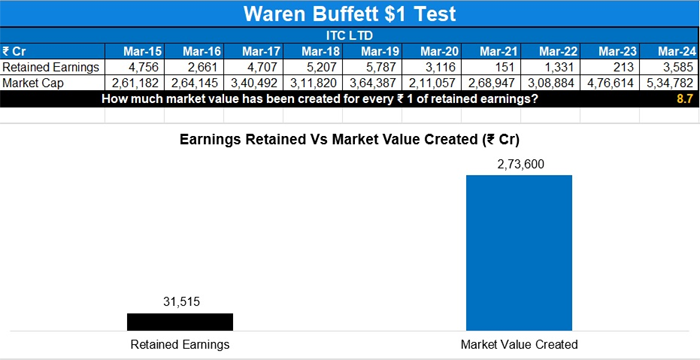

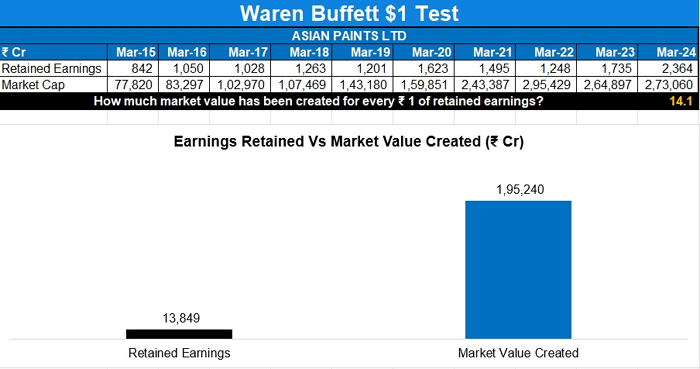

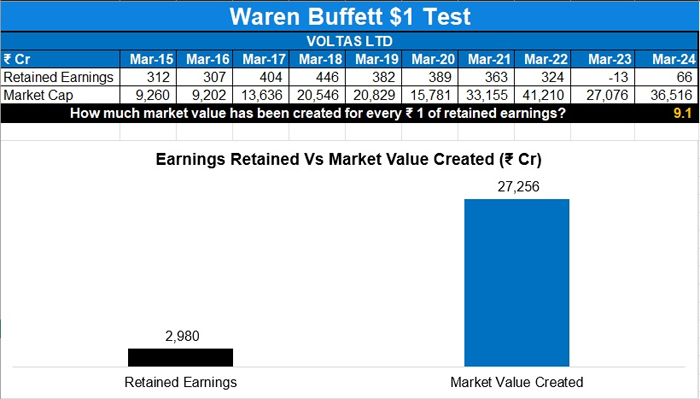

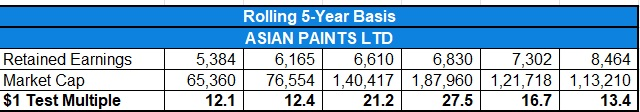

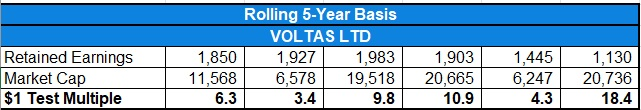

Now, let’s look at some real-life examples. We will analyze how companies like ITC, Asian Paints, and Voltas in India have performed on the ‘$1 Test’ over the past decade.

ITC has generated 8.7 rupees in market value for every rupee retained over the past decade. For Asian Paints, this figure was 14.1 times, and for Voltas, 9.1 times. These results indicate that these companies have used their retained earnings very efficiently.

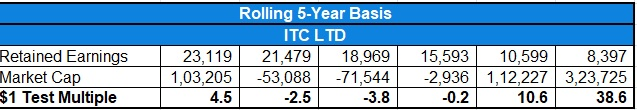

However, it’s essential to consider that short-term market fluctuations can impact results. For instance, ITC’s recent surge in market value has made the test results more favorable.

4. Advantages and Limitations of the $1 Test

The greatest advantage of this test is its ‘simplicity.’ It allows for evaluating a company’s long-term value without complex financial analysis. By asking just the question “Does the retained $1 create more than $1 of value?”, one can gauge a company’s performance.

However, this method has its limitations. In certain industries, companies may naturally need to retain more profits, so relying solely on the $1 Test could be risky. Therefore, it’s best to use this test in conjunction with other analysis methods.

Conclusion: The First Step to Successful Investing

Warren Buffett’s ‘$1 Test’ is a simple yet powerful tool. By using this test, you can quickly assess how well a company is utilizing its retained earnings. Apply this straightforward technique to your investment strategy—it could be your first step toward successful investing.

Reference: Safal Niveshak, “Warren Buffett’s $1 Test: A Simple Formula to Find Quality Companies”