Investing in stocks is like navigating the seas. There are days when the waves are crashing, and days when the sea is calm. But what truly matters is not leaving the ship and continuing towards your destination. Recent news headlines provide numerous reasons to sell your stocks: economic crises, rising interest rates, geopolitical risks, and new reasons seem to surface daily. But should you really sell your stocks because of these reasons? The answer is a resounding ‘No.’

Resist the Temptation to Sell Your Stocks

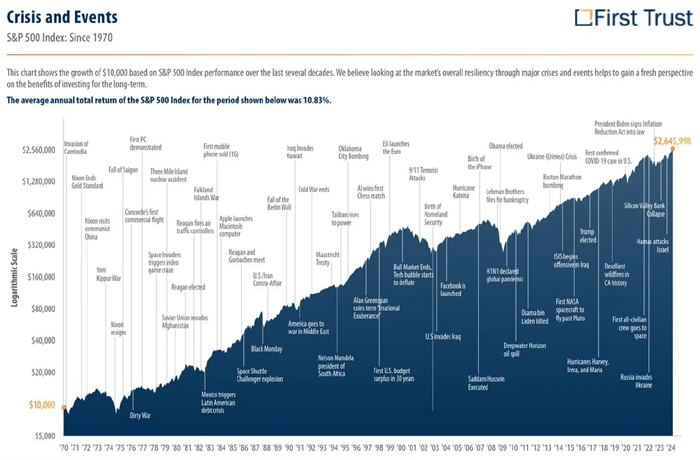

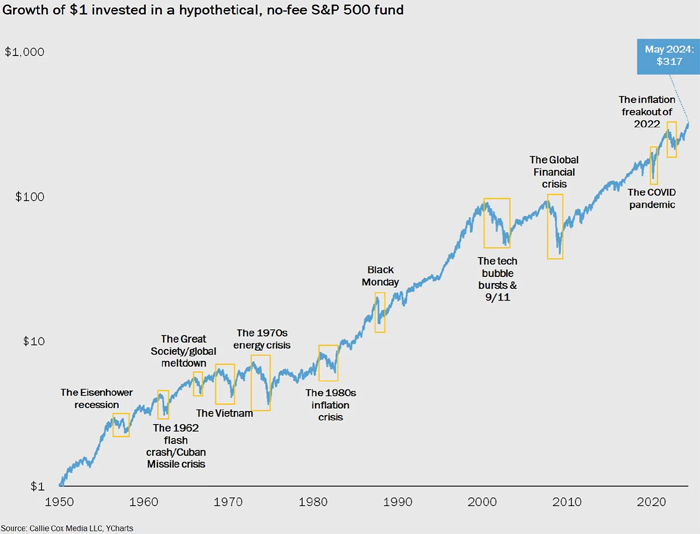

The temptation to sell your stocks hits everyone. When the market declines or news of an economic crisis spreads, it’s easy to think, “Now is the time to sell.” However, selling during these times often proves to be a poor decision in the long run. For example, since 1970, the S&P 500 index has faced countless economic crises and political upheavals, yet it has averaged an annual return of 10.83%. This demonstrates the importance of holding onto stocks long-term, rather than panicking over short-term downturns.

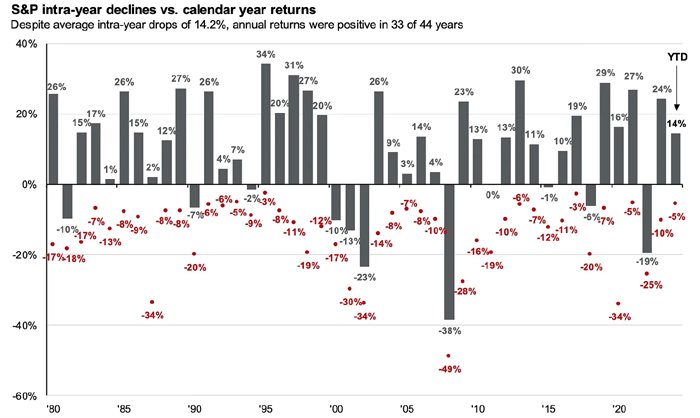

This graph shows the significant volatility in the S&P 500 index each year. However, what’s fascinating is that despite the average annual decline of 14.2% since 1980, most years still recorded positive returns. Volatility is an inherent part of investing, and it often presents opportunities to buy stocks at lower prices.

Tune Out the Noise and Keep Buying

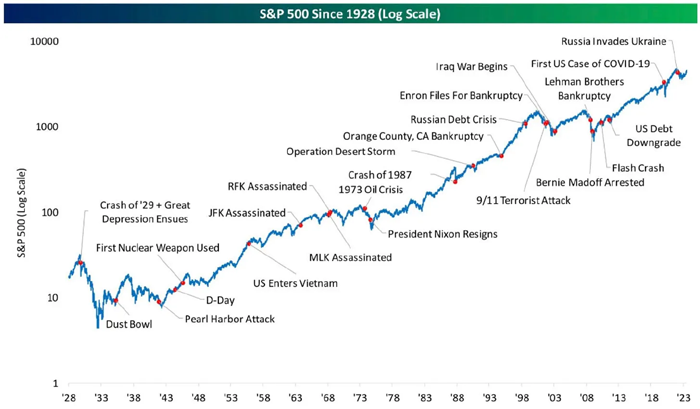

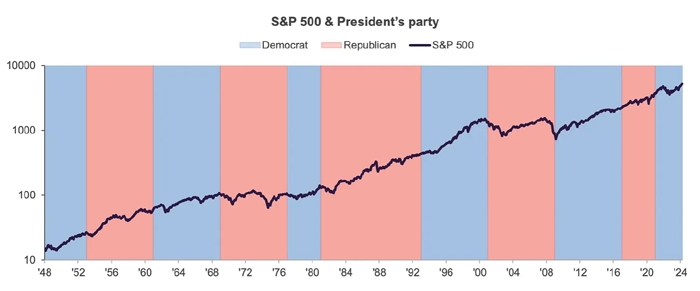

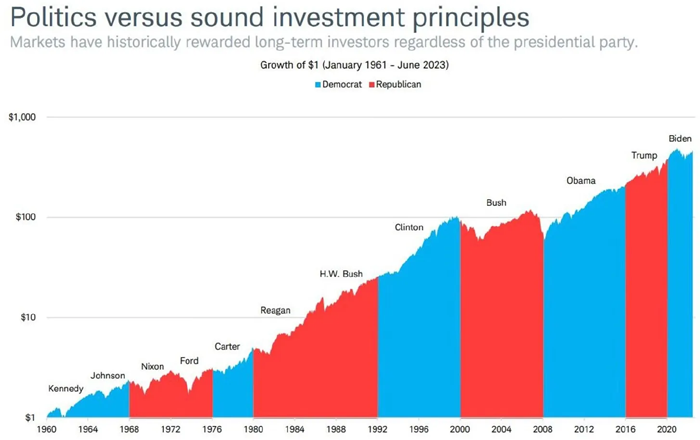

Various factors, such as interest rate changes, geopolitical risks, and political shifts, can cause fluctuations in the stock market. Yet, despite these factors, the long-term upward trend of the market has continued. For instance, since 1928, despite constant geopolitical risks, the S&P 500 index has steadily increased. This reminds us once again of the importance of holding stocks long-term.

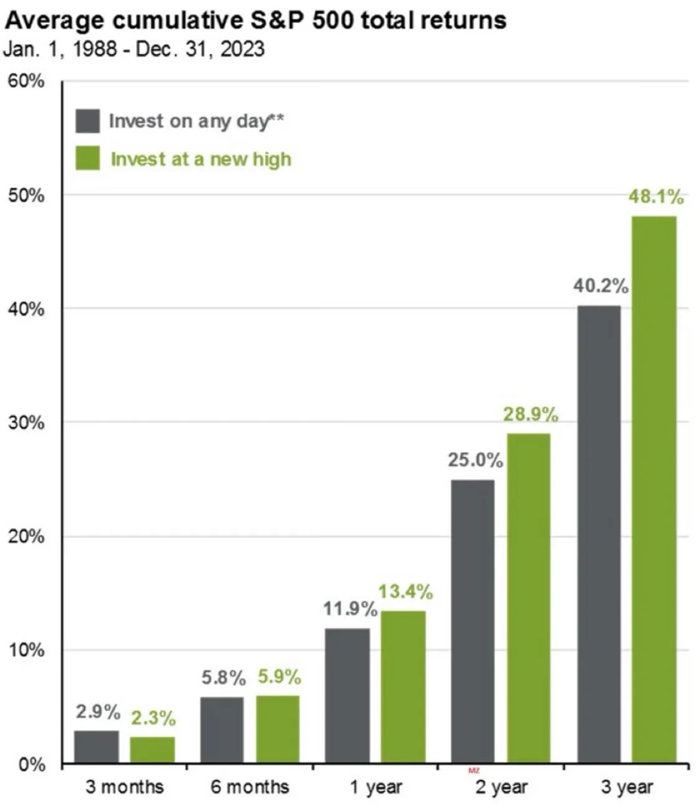

Moreover, finding reasons to sell your stocks at any given moment is not difficult. However, you should not be swayed by these reasons. Predicting market highs and lows is nearly impossible, so a consistent buying strategy is more likely to yield better long-term results.

Long-Term Investing: The Path of the Successful Investor

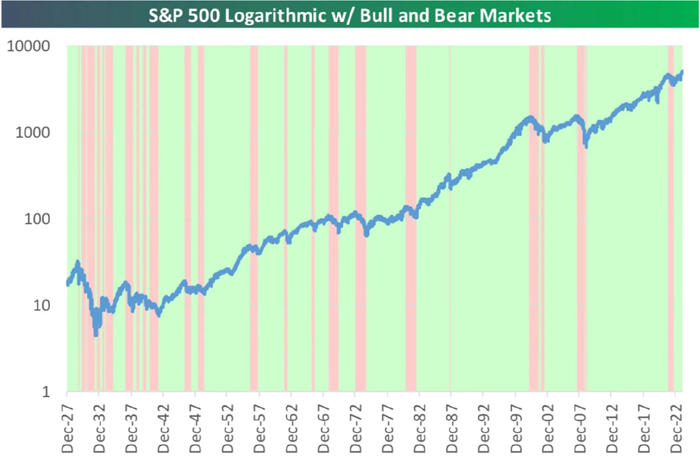

What truly matters now is ignoring short-term market fluctuations and holding onto your stocks long-term. [Many data points prove that consistently investing a fixed amount each month is the safest and most successful investment strategy]. For example, if you had invested one dollar in an S&P 500 fund in 1950, it would have grown to $317 today. This clearly illustrates the immense value of long-term investing.

In conclusion, rather than finding reasons to sell your stocks, staying invested in the market for the long term might be the wiser choice. By not being swayed by economic crises or interest rate fluctuations and consistently investing with a long-term perspective, you are following the path of a successful investor. So, don’t be distracted by market noise, and keep buying. Your future will be brighter.

Reference: Spilled Coffee, “Reasons To Sell”