Why do individual investors prefer “penny stocks”? Research indicates a strong tendency to favor the volatility of stocks that exhibit lottery-like payoff distributions. In this article, we will delve into the performance of penny stocks and the associated investment strategies in detail.

What are Penny Stocks?

Penny stocks typically refer to stocks that trade for less than $5 per share. This definition is commonly used by the U.S. Securities and Exchange Commission (SEC) and is referenced in many academic studies. While these stocks are attractive due to their low prices, which make them accessible to small investors, they also come with significant risks.

Why Do Investors Prefer Penny Stocks?

Why do individual investors prefer penny stocks? According to research, it’s because they irrationally favor highly volatile stocks with a high probability of “lottery-like” payoffs. In other words, individual investors are willing to take risks in the hope of high returns, similar to purchasing a lottery ticket with a small amount of money.

Performance Analysis of Penny Stocks

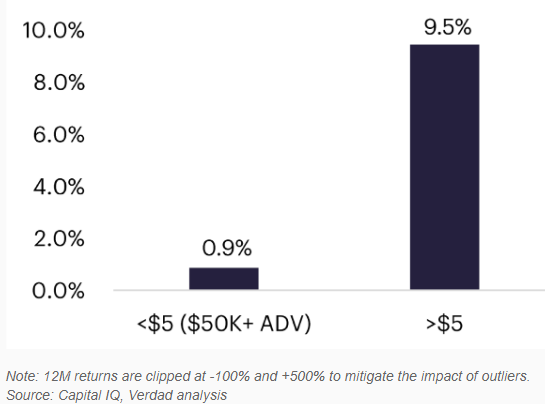

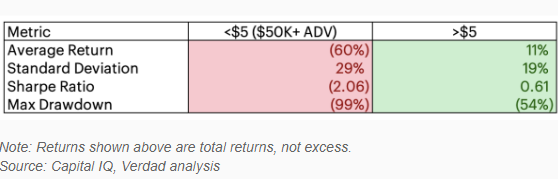

A study conducted by Burdard and his team thoroughly examined stocks traded on the NYSE, AMEX, and NASDAQ that were priced under $5 between 1996 and 2024. The study found that penny stocks, on average, underperformed stocks trading above $5 by 8.6% annually. The following chart illustrates these findings.

One of the causes of this underperformance is volatility. Penny stocks exhibit high volatility, with an average annual return of just 0.9%, while the market-cap weighted return was -60%. This indicates a significant positive skewness and fat tails in individual stock returns.

Penny Stock Performance Based on Market Conditions

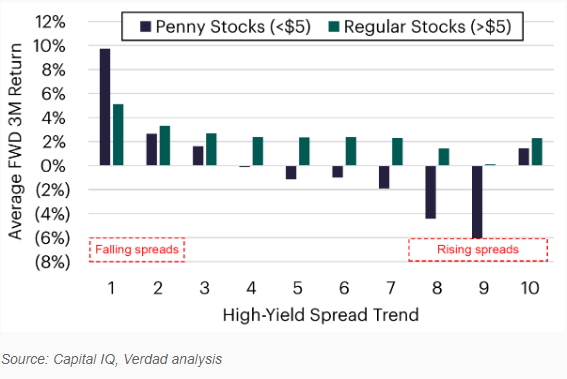

The researchers also compared the performance of penny stocks with the high-yield spread, which is the difference between the borrowing rates of junk bonds and U.S. Treasury rates. The study found that penny stocks performed best when the high-yield spread was declining rapidly. This suggests that penny stocks perform better during market panic periods.

Conclusion on Investment Strategies

Penny stocks are generally characterized by high volatility and low returns, making them less attractive for investment. However, during periods of rapidly declining high-yield spreads, penny stocks can yield high returns. Therefore, when investing in these stocks, it is crucial to carefully analyze market conditions and invest at the right timing.

Investing in penny stocks offers significant opportunities but also involves substantial risks. I hope this information helps you make informed and wise investment decisions.

Reference: Alpha Architect, “Explaining the Performance of Low-Priced Stocks: The Penny Stock Anomaly”