Frugality is the foundation of personal finance, but can you succeed in financial planning through frugality alone? Today, let’s explore this question through the story of “Absolute Retirement Man,” who saved 900 million won by skimping on meals. Despite his relentless saving, the outcome was not what he had expected.

1. Absolute Retirement Man’s Extreme Saving Methods

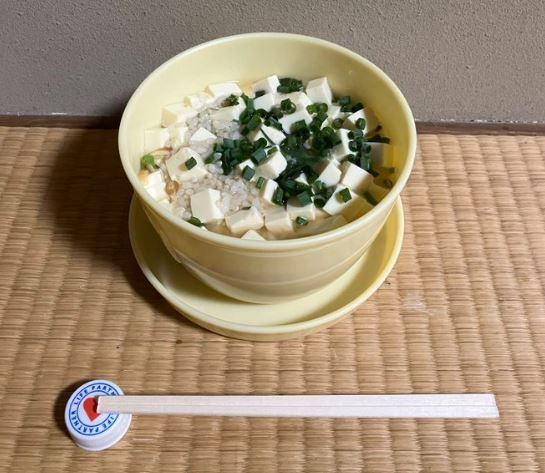

Absolute Retirement Man started minimizing his living expenses in his mid-20s, focusing solely on saving. His social media often featured dinner plates with “a single pickle, instant rice, and convenience store egg rolls.” By saving in this extreme manner, he had accumulated 90 million yen (approximately 800 million won) last year and was on track to achieve his goal of 100 million yen (around 900 million won). His extreme saving methods garnered significant attention from many people.

2. The Beginning of Regret: Yen Depreciation and Inflation

On the 28th of last month, Absolute Retirement Man posted on social media, “If the yen continues to depreciate like this, being part of the FIRE movement might no longer be feasible.” He realized that his 21 years of saving had been undermined by inflation and yen depreciation. His post made many people aware that frugality alone cannot shield against economic instability. As his case shows, yen depreciation and inflation erode our savings.

3. Frugality Alone Is Not Enough: The Need for Smart Investment

The experience of Absolute Retirement Man teaches us an important lesson. Frugality is essential, but it is not sufficient. Along with saving, smart investment is necessary. The value of money changes over time. While earning and saving money are important, how you grow that money is equally crucial.

4. Balancing Frugality and Investment

Through the example of Absolute Retirement Man, we can learn the importance of a balanced approach to personal finance. Along with saving, growing your assets through investment is necessary. Saving alone cannot resolve economic insecurity. Balancing investment and saving is the key to successful personal finance.

Conclusion: Achieving Both Frugality and Investment

The story of Absolute Retirement Man offers many insights. Frugality is essential, but it is not enough. We must seek financial stability by balancing frugality with smart investment. May you achieve successful personal finance by striking this balance. Start now!