How will the future stock market change? Tom Lee’s predictions bring great hope to many investors. Recently, Tom Lee from Fundstrat presented a highly optimistic outlook, predicting that the S&P 500 index will triple by 2030. How did this forecast come about? Let’s explore the reasons with four key charts.

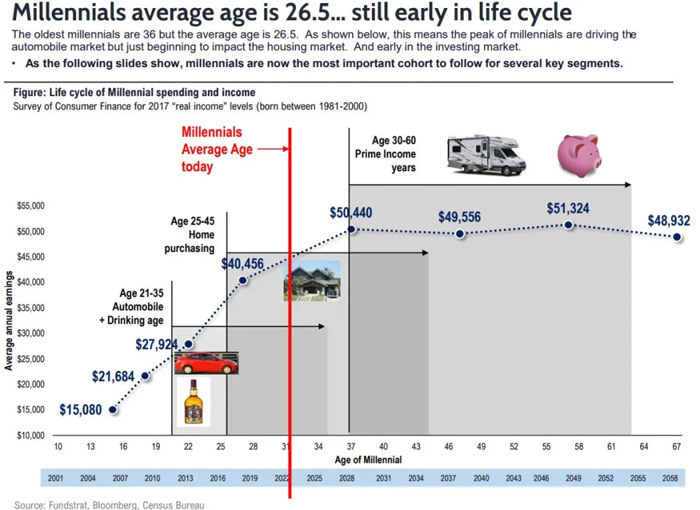

1. The Power of Millennials

Millennials are becoming the driving force of the economy. With an average age of 31, this generation will be at the center of economic activity for the next 20 years. This suggests that the stock market could achieve an annual compound growth rate in the low teens, marking the third major growth cycle following the roaring 1920s, 1950s, and late 1960s.

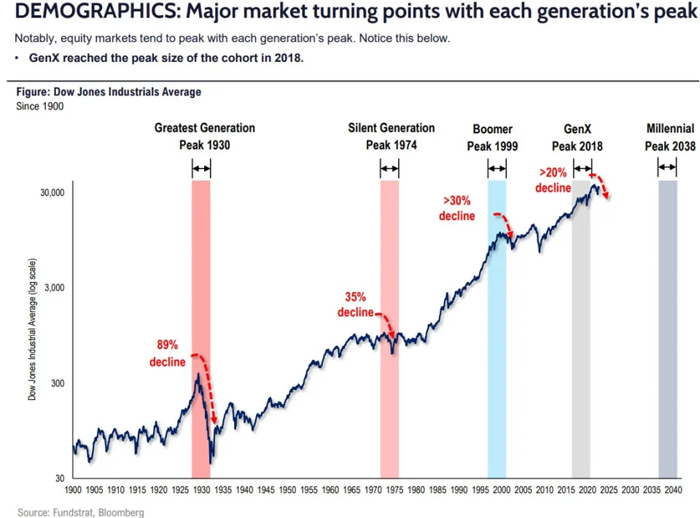

2. Demographics and the Stock Market

Historically, stock markets have peaked when the population around age 50 reached its prime. As millennials are expected to hit their prime around 2038, there is ample room for stock market growth until then.

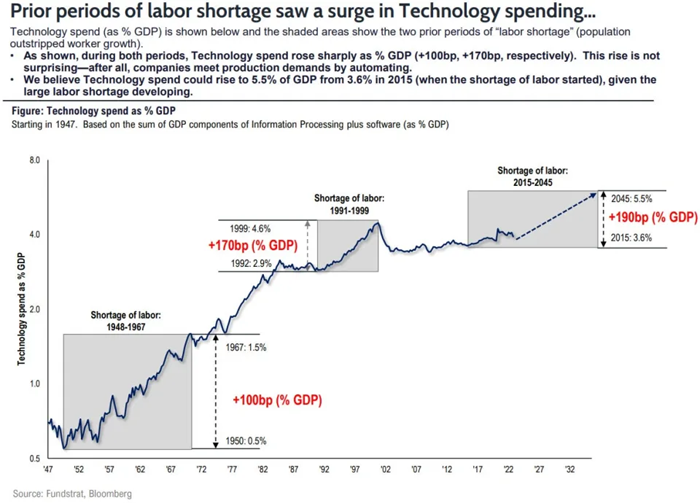

3. The Role of Technology

Technological innovation will address the global labor shortage. As digital technologies like AI replace labor, U.S. tech companies will experience massive growth. This will positively impact the stock market over the next decade.

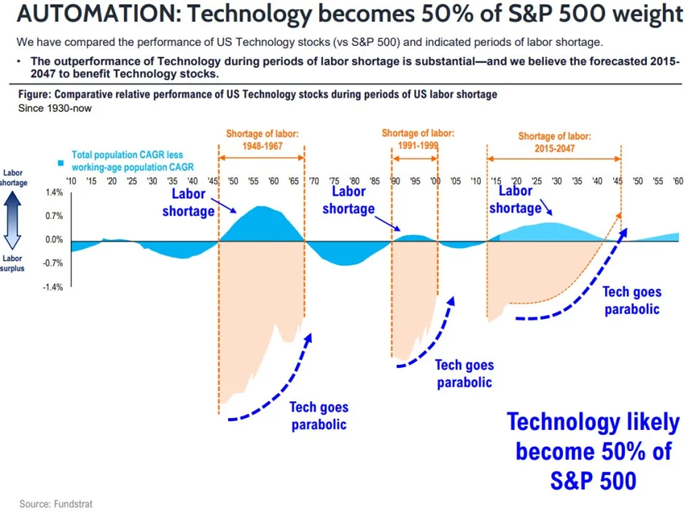

4. Inflow of Capital

Capital inflows into U.S. tech stocks will continue. With few competitors as strong as U.S. tech companies worldwide, investors will keep investing in U.S. stocks. It won’t be long before the information technology sector makes up 50% of the S&P 500.

Conclusion: Invest in the Future

Tom Lee’s predictions offer insight into how the stock market might evolve. The growth in economic activity among millennials, accelerated technological innovation, and the strength of U.S. tech stocks will drive the continued rise of the stock market. This outlook emphasizes the importance of investing now. Trust in the future of the stock market and invest wisely. Successful investing awaits you.

Source: Business Insider, “4 charts show why Wall Street’s most bullish strategist expects the stock market to triple by 2030”