Are bonds safe investments? Many people think that government bonds are always safe. However, this article will explain the hidden risks of bond investing and how to manage these risks.

1. Basic Concept of Bond Investing

A bond is essentially an IOU issued by a government or a company to raise funds. The investor lends money to the issuer and receives regular interest payments, with the principal repaid at maturity.

For example, let’s say you invest 100 million won in a 10-year bond that pays 4% annual interest. You will receive 4 million won in interest each year and get back the principal of 100 million won after 10 years.

However, it is important to note that various risks exist in bond investing.

2. Risks in Bond Investing

Credit Risk

Credit risk arises if the issuing entity defaults or fails to pay interest. This is common in corporate bonds, whereas government bonds are typically considered to have lower credit risk.

Interest Rate Risk

When interest rates rise, bond prices fall. For example, if the current interest rate is 2%, a bond paying 4% is attractive. However, if the interest rate rises to 5%, new bonds offering higher interest rates will be more appealing, causing the price of the 4% bond to drop. Investors trying to sell such bonds may incur losses.

Inflation Risk

Inflation reduces the real value of the interest received from bonds. For example, if the interest rate is 3% but inflation is 4%, the real value of the money decreases.

3. Real-World Examples

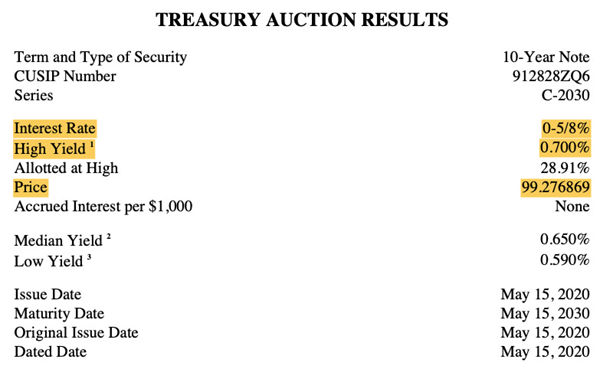

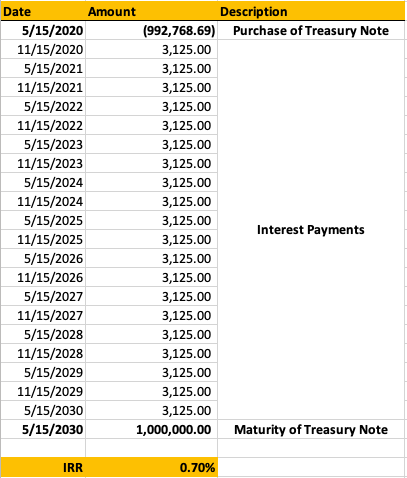

To illustrate, in May 2020, the U.S. Treasury issued a 10-year bond paying 0.625% annual interest. Investors bought these bonds for stability despite the low yield due to the prevailing low interest rates.

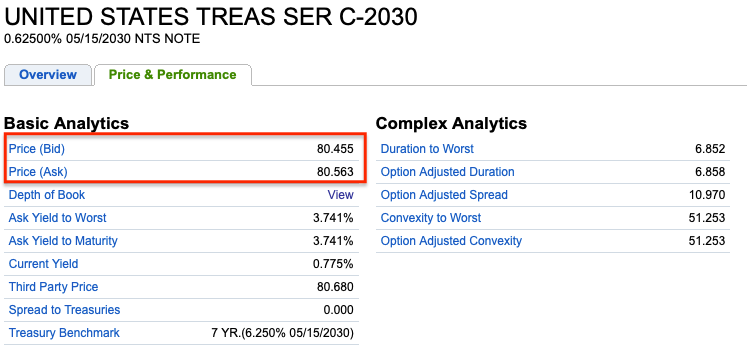

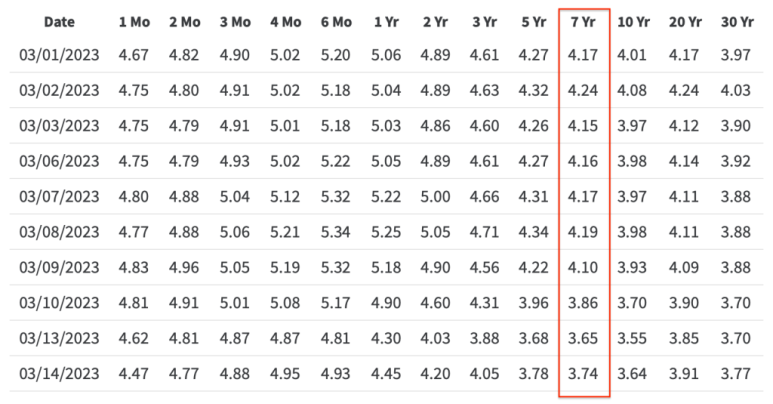

However, by March 2023, interest rates had surged. Investors needing to recover their principal before maturity had to sell their bonds at a loss due to the price drop caused by rising interest rates.